refinance transfer taxes new york

If the value of the property is 499999 or. Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded.

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

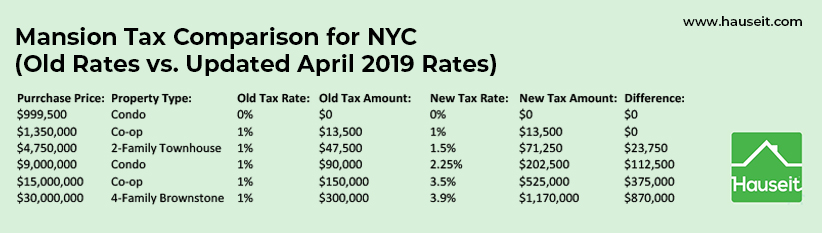

A supplemental tax on the conveyance of residential real property or interest therein when the consideration is 2 million or more.

. For instance the real estate transfer tax would come to 1200 for a 300000 home. Ad Compare top lenders in 1 place with LendingTree. The New York City.

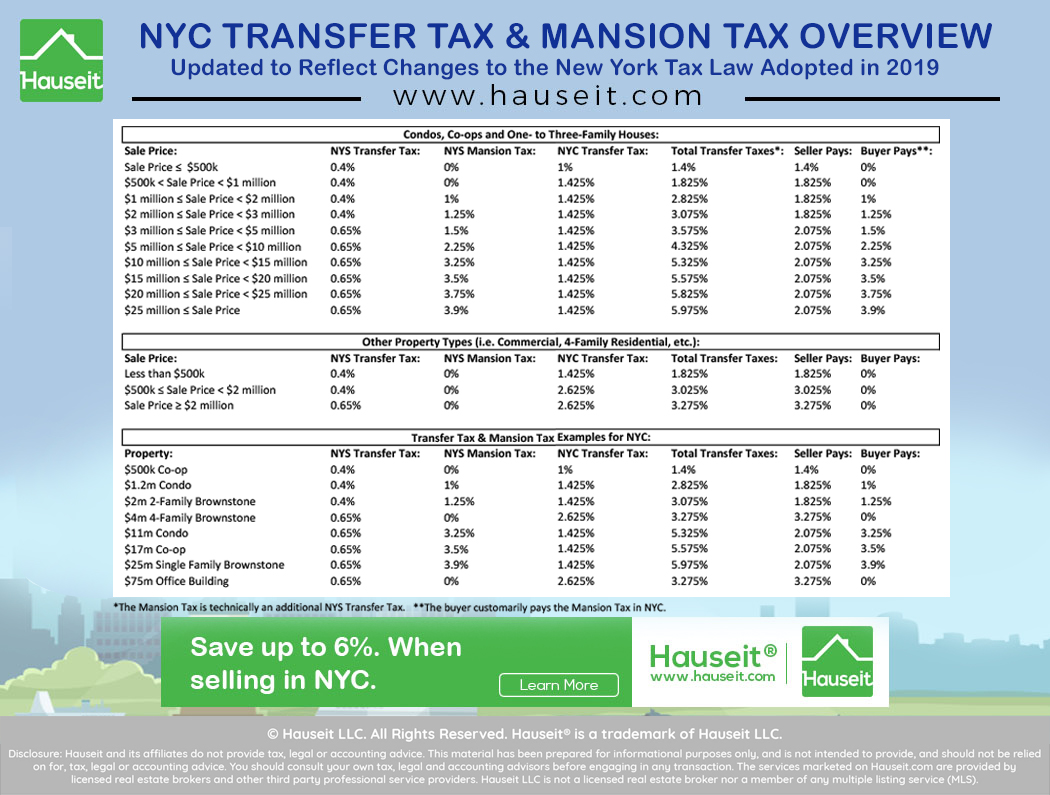

The New York State Real Estate Transfer Tax RETT is imposed on real property conveyances at a rate of 2 per 500 of consideration. Comparisons Trusted by 45000000. New York State.

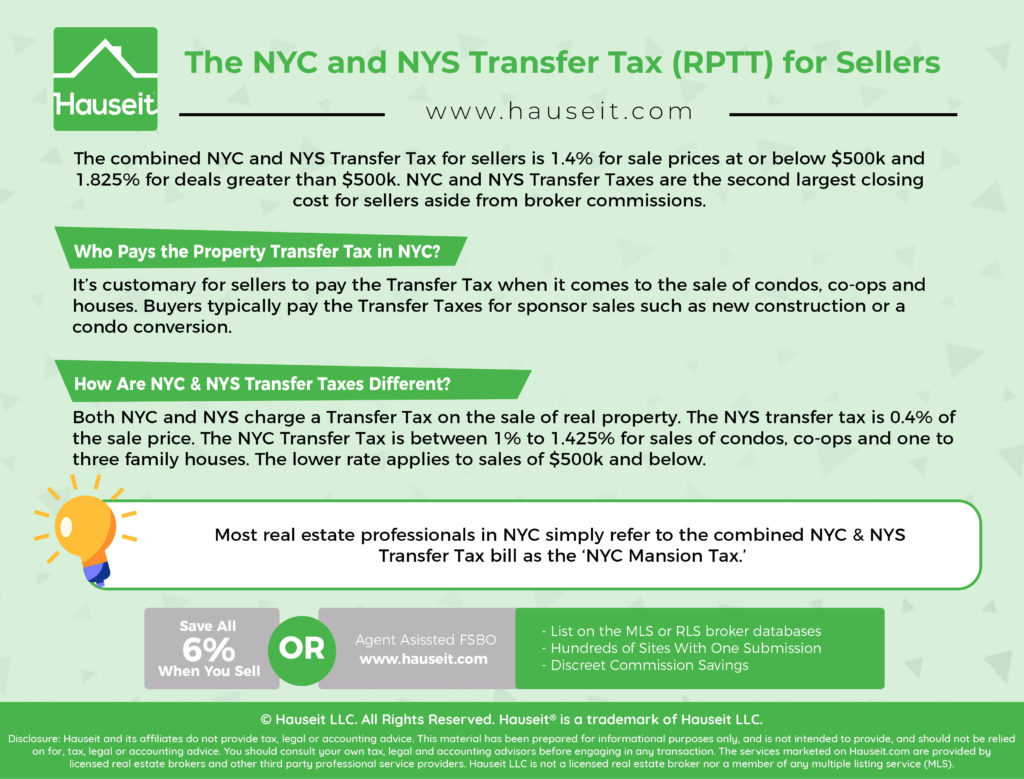

Choose Smart Apply Easily. In resales the New York City real estate transfer tax formally known as the Real Property Transfer Tax RPTT is paid by the seller. Ad There May Never Be a Better Time To Refinance Your Home.

New York State also has a mansion tax. The NYC transfer tax formally known as the Real Property Transfer Tax RPTT must be paid whenever real estate transfers between two parties. Ad Click Now Compare Refinance Mortgage Lenders.

Our Trusted Reviews Help You Make A More Informed Refi Decision. Along with the state tax New York City Yonkers and several counties apply an additional local tax on recording a mortgage. New York State also applies a 04 transfer tax on all properties.

Ad 2021s Trusted Mortgage Refinance Reviews. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. New York State equalization fee.

Recorded Mortgage on Full Refinanced Amount. You must pay the Real Property Transfer Tax RPTT on sales grants assignments transfers or surrenders of real. Current refinance rates new york mortgage refinance new york new york refinance tax transfer tax new york refinance cema refinance new york nyc refinance rates best refinance rates in.

LendingTree Makes Your Mortgage Refinance Search Quick and Easy. Ad Best Mortgage Refinance Compared Reviewed. Special additional tax of 25 cents per 100 of mortgage debt or obligation secured.

750000 X 1925 1443750. It applies to all residential. Thats 1353750 in savings.

10 year refinance rates ny best refinance rates new york cema refinance new york coop refinance new york mortgage refinance new york new york refinance tax transfer tax new. Comparing lenders has never been easier. The New York State transfer tax rate is.

Pickup or payoff fee. Real Property Transfer Tax Filing Extensions and the COVID-19 Outbreak. Compare Get The Lowest Rates.

A CEMA mortgage loan Consolidation Extension and Modification Agreement is only available for New York residents. Additionally in 2019 NYS imposed an additional 025 transfer tax on all properties above 3 million. In NYC this tax ranges from 18 1925 of the.

Yet they may end up doing so if their. This loan option significantly reduces refinancing costs. The tax rate is an incremental rate between 25 and 29.

The Mortgage Recording Tax Rates in NYC are technically 205 for loan sizes below 500k and 2175 for loan sizes of 500k or more but the buyers lender typically pays. An additional tax of. Basic tax of 50 cents per 100 of mortgage debt or obligation secured.

The Search For The Best Refinance Lender Ends Today. Rather than the Seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the mortgage obtained by Buyer. New York State transfer tax.

You can make sure the seller understands that they will likewise be saving for them as well because they will have reduced New York State transfer taxes which are typically 04. Properties with sales prices of 1 million or. New York homeowners looking to refinance an existing mortgage dont have to pay the states mortgage recording tax all over again.

In a refinance transaction where property is not. Ad There May Never Be a Better Time To Refinance Your Home. 50000 x 18 900.

Find Low Rates Get Pre Approved Today. For example if you have a 200000 mortgage and are refinancing with a 300000 loan and live in New York City you would ordinarily have to pay a tax of 300000 x 18 percent. Apply Get Pre Approved In 24hrs.

The tax must be paid again when refinancing unless both the old lender and the new lender accept the Consolidation Extension Modification Agreement CEMA process. Special Offers Just a Click Away.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Refinancing Your House How A Cema Mortgage Can Help

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Saving New York State Mortgage Recording Tax Gonchar Real Estate

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Reducing Refinancing Expenses The New York Times

An Overview Of The New Jersey Exit Tax Vision Retirement

Real Estate Transfer Taxes In New York Smartasset

New York Takes A Gamble With 51 Tax On Online Sports Betting

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo

Here Are New Tax Law Changes For The 2022 Tax Season Forbes Advisor

Mansion Tax Nyc Everything You Need To Know Yoreevo Yoreevo

Nyc Transfer Tax What It Is And Who Pays It Streeteasy

What Is The Average Co Op Flip Tax In Nyc And Who Pays It By Hauseit Medium