interest tax shield là gì

Tax Shield Value of Tax-Deductible Expense x Tax Rate. Tax Shield Deduction x Tax Rate.

La Chắn Thuế Tax Shield La Gi Y Nghĩa Của La Chắn Thuế

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest Deduction As Mortgage Interest Mortgage.

. Interest Tax Shield Interest Expense Tax Rate. Admin 21 Tháng Mười 2021. So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240.

Deduction such as amortization charitable contribution depletion depreciation medical expenses mortgage interest and un-reimbursed expense that. Thông tin thuật ngữ. For instance if the tax rate is 210 and the.

Tax shield là Tấm chắn thuếĐây là nghĩa tiếng Việt của thuật ngữ Tax shield một thuật ngữ được sử dụng trong lĩnh vực kinh doanh. The effect of a tax shield can be determined using a formula. ĐÂY rất nhiều câu ví dụ dịch chứa TAX SHIELD - tiếng anh-tiếng việt bản dịch và động cơ cho bản dịch tiếng anh tìm kiếm.

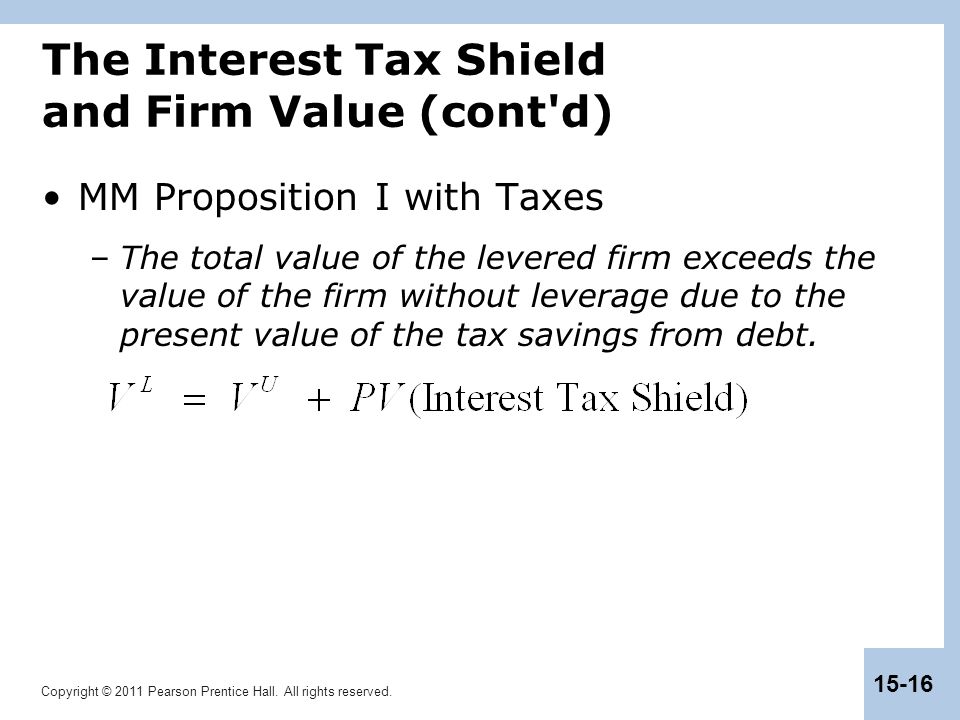

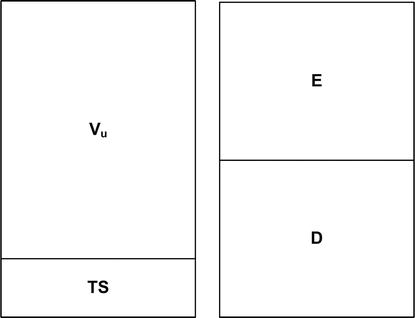

The payment of interest expense reduces the taxable income and. The valuation of the interest tax shield capitalizes the total value of the firm and it limits the tax benefits of the debt. Tax benefits derived from creative structuring of a financing arrangement.

The interest tax shield relates to interest payments exclusively rather than interest income. An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation. The value of the interest tax shield is equal to the present value of the expected future tax shields discounted at the rate of the cost of interest tax shields KITS.

As interest expenditures are tax-deductible tax shields play. Tax Shield is calculated as. Usually the main benefit is a tax shield resulted from tax deductibility of interest payments.

Định nghĩa Tax shield là gì. The formula for calculating the interest tax shield is as follows. Definition - What does Tax shield mean.

Assume for simplicity that. Tax Shield Donation to Charitable Trusts Interest Expenses Depreciation Expenses Applicable Tax Rate. Definition - What does Interest tax shield mean.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses. Định nghĩa ví dụ giải thích. Interest payments are deductible expenses for most companies.

Tax Shield 5000 40000 10000 35. This is usually the deduction multiplied by the tax rate. Thông thường lợi ích chính là một lá chắn thuế kết quả từ khấu trừ thuế của các khoản thanh.

Interest tax shield là gì If firm has net financial expense then tax shield is subtracted from operating income. Dịch trong bối cảnh TAX SHIELD trong tiếng anh-tiếng việt. Tax Shield là gì.

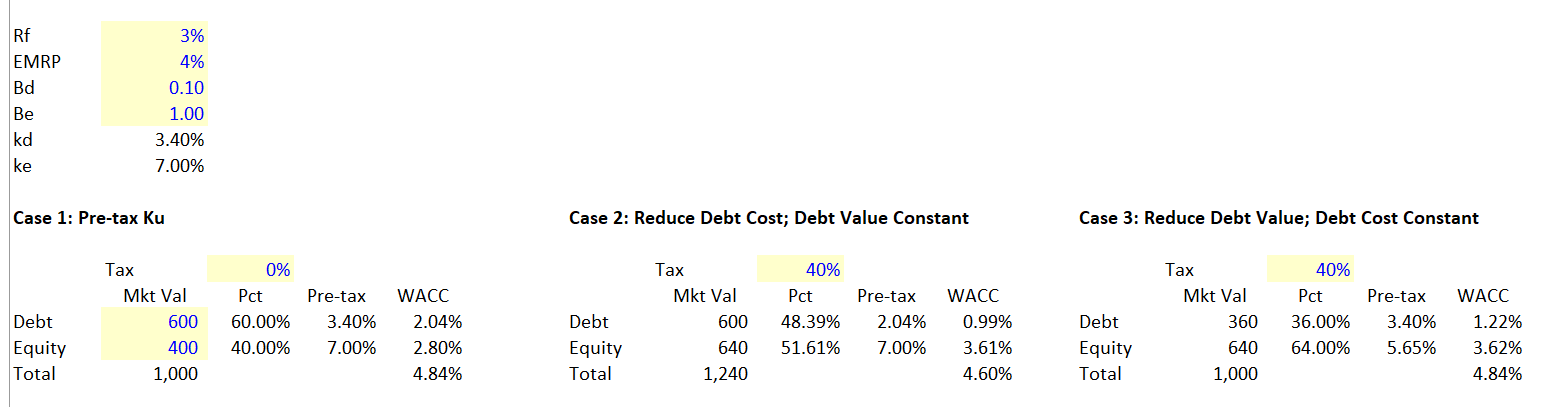

The Interest Tax Shield refers to the tax savings resulting from the tax-deductibility of the interest expense on debt borrowings. CAPM để làm g ì-Risk free rate-Beta of the security -Market. Interest Tax Shield Formula.

For example using loan capital instead of equity capital because.

Chapter 15 Debt And Taxes Ppt Download

Risky Tax Shields And Risky Debt An Exploratory Study

Tax Shield Definition Example How Does It Works

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Interest Tax Shield La Gi Liked It A Lot Record Image Bank

La Chắn Thuế Tax Shield La Gi Y Nghĩa Của La Chắn Thuế

Interest Tax Shield What Is The Tax Shield

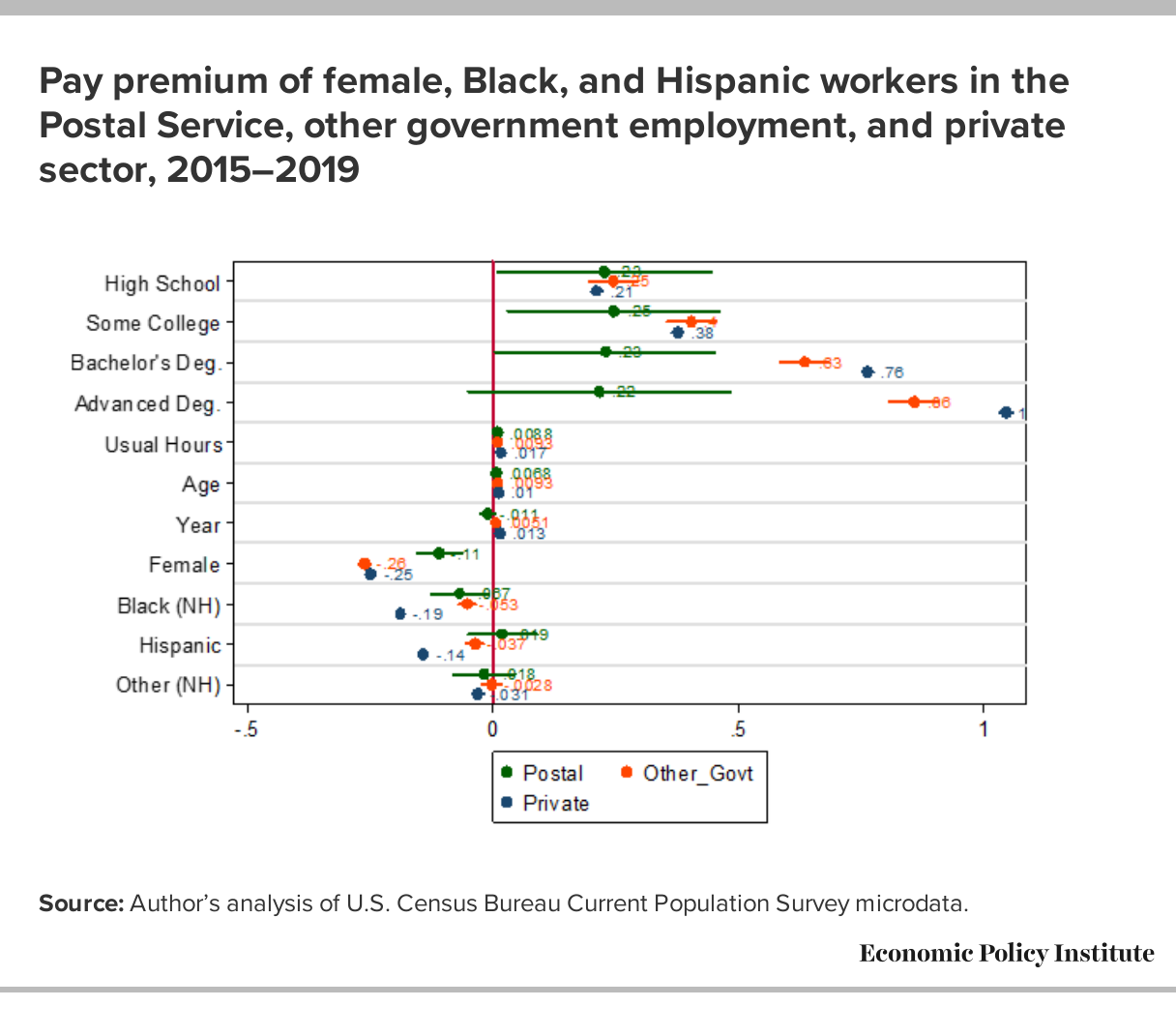

The War Against The Postal Service Postal Services Should Be Expanded For The Public Good Not Diminished By Special Interests Economic Policy Institute

Solved Example Interest Tax Shield Annual Interest Tax Chegg Com

The Interest Tax Shield Explained On One Page Marco Houweling

Amazon Com Curad Germ Shield Antimicrobial Silver Wound Gel 0 5 Ounces 1 Tube For Topical Cuts Wounds Diabetic Sores Mrsa Bacteria Fungus Yeast Industrial Scientific

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Risky Tax Shields And Risky Debt An Exploratory Study

Interest Tax Shields Use Interest Expense To Lower Taxes

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Are Scholarships And Grants Taxable H R Block

Amazon Com Pokemon Sword And Shield Brilliant Stars Build And Battle Box 5 Booster Packs Toys Games

La Chắn Thuế Tax Shield La Gi Y Nghĩa Của La Chắn Thuế Thongkenhadat